What To Look For In Stoughton Business Insurance

Starting a business requires investment, which can often come from your own hard earned money. The success of a business depends on a number of factors, like market conditions, demand for whatever you are seeking to sell, and often involves hiring and paying employees, suppliers, and others. Starting a business can always be a risk and you need to find ways to mitigate these risks in the best way that you can.

One way to do this is to obtain sufficient Stoughton business insurance cover so that you are less at risk. You need to cover basic liabilities, your furniture and fixtures, and even vehicles. Business insurance is mainly divided into three broad categories:

1) Insurance for all stakeholders and key employees.

2) Insurance for property and business earnings.

3) Insurance against any liabilities.

The first category will require life insurance, disability insurance, partnership insurance, critical illness insurance, and key person insurance.

Property and business earning insurance cover protection of earnings and protection of assets. You will also require to provide for insurance to any property that the business owns so that it is protected against fire, and other disasters. It is also necessary to protect the contents of the buildings separately. This is necessary even when a property is leased. Vehicles need to be covered as do risks covered with any interruption to the business.

Liability insurance covers the business in case of any accidents or mistakes that occur during the conduct of the business. Here you can cover personal responsibility when there is any problem with the products or services you provide as part of your business. You can also be protected from any lawsuits brought by any clients. Workmen compensation is another insurance that is required by law and is meant to cover all your employees for medical costs and lost wages resulting from an accident that has occurred during work.

Insurance is needed to protect any business from risks that have not been foreseen. It can give an owner a great peace of mind if the insurance cover is adequate. Adequate cover is a must, and businesses must be careful to weigh the risks involved when they prefer to pay low premiums in order to reduce costs. Adequate insurance will ensure smooth business operations and often allow you to resume operations quickly after any unexpected events have interrupted them.

Calculate carefully the total value of assets, their replacement costs, and other factors, before you settle on any insurance coverage for your business.

Some subscription clubs are expensive. People want to sign up for services like this, but they aren’t comfortable with the high cost. Thankfully, this isn’t an issue with jerky subscriptions. If you sign up for something like this, you will be able to enjoy a very low price.

Some subscription clubs are expensive. People want to sign up for services like this, but they aren’t comfortable with the high cost. Thankfully, this isn’t an issue with jerky subscriptions. If you sign up for something like this, you will be able to enjoy a very low price. For

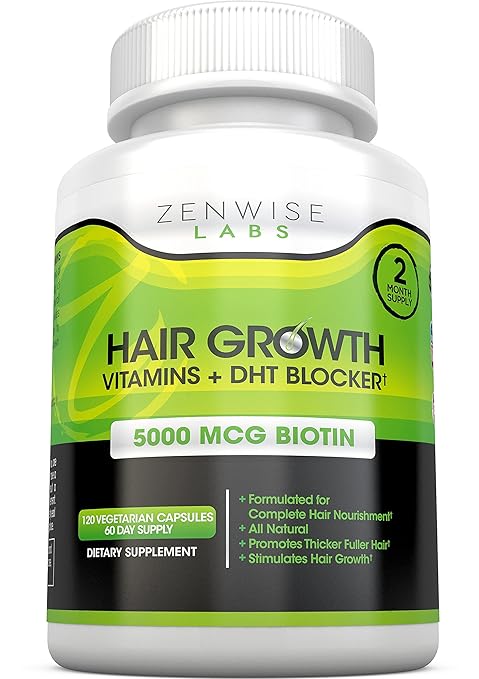

For  Interestingly, lavender oil has also proven useful for stopping hair loss. Scientific study has shown that patients with alopecia ” the cause of most major forms of balding ” showed actual healthy new hair growth after rubbing the oil into their scalp on a daily basis. One to four-ounce bottles can easily be obtained for around $10.

Interestingly, lavender oil has also proven useful for stopping hair loss. Scientific study has shown that patients with alopecia ” the cause of most major forms of balding ” showed actual healthy new hair growth after rubbing the oil into their scalp on a daily basis. One to four-ounce bottles can easily be obtained for around $10.